Is Ethical collection an integral part of healthy financial system?

Indonesia is a very attractive market for many business sectors. It is developing rapidly. This also applies to FinTech companies. Today we can talk about the FinTech boom: this sector, especially lending, is fast growing. This is a positive shift in the country’s development – as an archipelago country with 17,504 Islands, limited infrastructure and credit information, FinTech in Indonesia has the ability to address the challenges of financial integration.

The Government understands the importance of this process and supports financial development. But the availability of credit for most of the country’s population carries the threat of rising debt and over-indebtedness. That can disrupt the balance of the financial ecosystem.

Understanding the importance of technology development and its availability throughout the country, adjustments were made, and regulations were established. Debt formation is an inevitable moment of monetary relations, and the right approach to the repayment of overdue debts and the return of debtors as reliable clients is an important step for the building of a developed financial system.

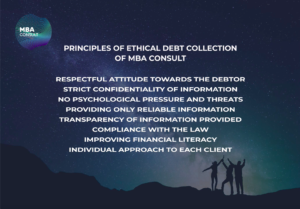

“We are closely monitoring the changes that were being implemented. Now we can talk about building a civilized debt recovery market in the country. And we are glad that our company is an integral part of this system and take an active part in its formation. Our Group has existed more over 20 years on the market, and all of our companies strictly follow the principles of ethical collection. In our vision, the debtor is primarily a client of the company, which should be treated with respect and understanding. Everyone can get into a difficult life situation, and our goal is to help to find a solution that will satisfy all stakeholders,” – commented Wihantoko, President Director of MBA Consulting Indonesia.

“We are closely monitoring the changes that were being implemented. Now we can talk about building a civilized debt recovery market in the country. And we are glad that our company is an integral part of this system and take an active part in its formation. Our Group has existed more over 20 years on the market, and all of our companies strictly follow the principles of ethical collection. In our vision, the debtor is primarily a client of the company, which should be treated with respect and understanding. Everyone can get into a difficult life situation, and our goal is to help to find a solution that will satisfy all stakeholders,” – commented Wihantoko, President Director of MBA Consulting Indonesia.

Collection agencies have a very important social mission – they help to solve difficult financial situations and find the ways out of them. And that is why ethical principles of repayment of overdue debts are so important: they help to maintain a balance of interests and influence the state of the financial system.